Current bond price formula

As mentioned above the bond price is the net present value of the cash flow generated by the bond and can be calculated using the bond price equation below. Calculate Price of a fixed-income security.

Bond Yield Formula Calculator Example With Excel Template

Finally the formula for current yield can be derived.

. Calculate the bond price. Hence the price for Bond A will be. Ad Use Our Simple Tools To Create Your Bond Strategy.

He can use the following formula. N Number of payments per period x Number of years to maturity 2 x 9 18 i YTM Number of payments per period 8 2 4 or 004 FV The Bonds Face Value 1000. Note however that this convexity approximation formula must be used with this convexity adjustment formula then added to the duration adjustment.

It represents the investors expected return instead of the actual return if the owner purchased. Now lets calculate the price fixed-income security per 100 of face value. So you would divide the par value by its interest rate and use the result for variable A.

YTM is the return an investor gets if he holds the bond until maturity. The algorithm behind this bond price calculator is based on the formula explained in the following rows. Using the example in the calculator but with 45 days elapsed.

Annual coupon payment Current market price 100 1500 666 For XYZ Annual coupon payment Current market price 100 1200 833 Well clearly it is the Bond with a higher yield that attracts the investor as it gives a higher return on Investment. Before we derive the Bonds price lets compute all the components that will be used in the main equation. For the coupon amount you would need to know the cash value that you are earning from the bond because of its interest.

Mrpopzit ear blackheads The cash flows from this bond are 30 30 30 and 1030. Current Yield Discount. The formula for calculating the value of a bond V is.

F Par value of the bond repayable at maturity r discount factor or required rate of return. The current yield is the annual return of a bond based on the annual coupon payment and current bond price vs its original price or face. P 0 Bond price.

Next figure out the current market price of the bond. The Formula used for the calculation of Price of the corporate bond is. P - Bond price when interest rate is incremented.

To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for. Bond price Σ k1 n cf 1 r k where. The market interest rate is 10.

Δy change in interest rate in decimal form. Mathematically it the price of a coupon bond is represented as follows Coupon Bond i1n C 1YTMi P 1YTMn Coupon Bond C 1- 1YTM-nYTM P 1YTMn You are free to use this image on your website templates etc Please provide us. This figure is used to see whether the bond should be sold at a premium a discount or at its face valueas explained below.

How to Determine the Discount Rate. Bond Current Yield Calculation. 8 100000.

N - Years to maturity. 1000 12 45180 1250 The Dirty Price and Clean Price Formulas. Current Yield Coupon Rate Par Value Bond Quote.

Discount Bond 60 950 632 Par Bond 60 1000 600 Premium Bond 60 1050 571 If a bond is trading at par the current yield is equal to the stated coupon rate thus the current yield on the par bond is 6. I annual interest payable on the bond. P Bond price when interest rate is decremented.

Current Yield Formula. Company A has issued a bond having face value of 100000 carrying annual coupon rate of 8 and maturing in 10 years. F Facepar value.

For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by the current bond quote. Market interest rate represents the return rate similar bonds sold on the market can generate. The current yields of a bond can also inform you of interest rate changes.

Cf - Cash flows. F Face value of the bond r Coupon rate PY Payments a Year E Days elapsed since last payment TP Time between payments from above description. In other words the Price of the corporate bond per 100 face value is 11204.

N maturity of the bond. For each bond the current yield is equal to the annual coupon divided by the bonds face value FV. The price of the bond is calculated as the present value of all future cash flows.

Bond price cash flowt 1 ytmt the formula for a bonds current yield can be derived by using the following steps. Current yield annual coupon interest bond price 4000 18200 02197 The current yield is 2197 if you multiply 02197 by 100 to. The current yield formula takes into consideration the current price of the bond instead of the face value of the bond.

Firstly determine the potential coupon payment to be generated in the next one year. PRICEC4C5C6C7C8C9C10 The PRICE function returns the value.

Learn How To Calculate Bond Price Value Tutorial Definition Formula And Example

Yield To Call Ytc Bond Formula And Calculator Excel Template

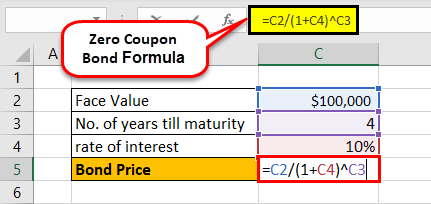

Zero Coupon Bond Formula And Calculator Excel Template

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate The Current Price Of A Bond Youtube

Excel Formula Bond Valuation Example Exceljet

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

Coupon Bond Formula How To Calculate The Price Of Coupon Bond

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Yield Calculator

Bond Pricing Formula How To Calculate Bond Price Examples

Bond Pricing Formula How To Calculate Bond Price Examples

How To Calculate Bond Price In Excel

How To Calculate Bond Value 6 Steps With Pictures Wikihow

An Introduction To Bonds Bond Valuation Bond Pricing

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity